Home > Investment Guide > Investing Basics

ChargePoint’s Leading Position and Differentiated Strategy Make it a Long-Term Winner

Leading EV charging network

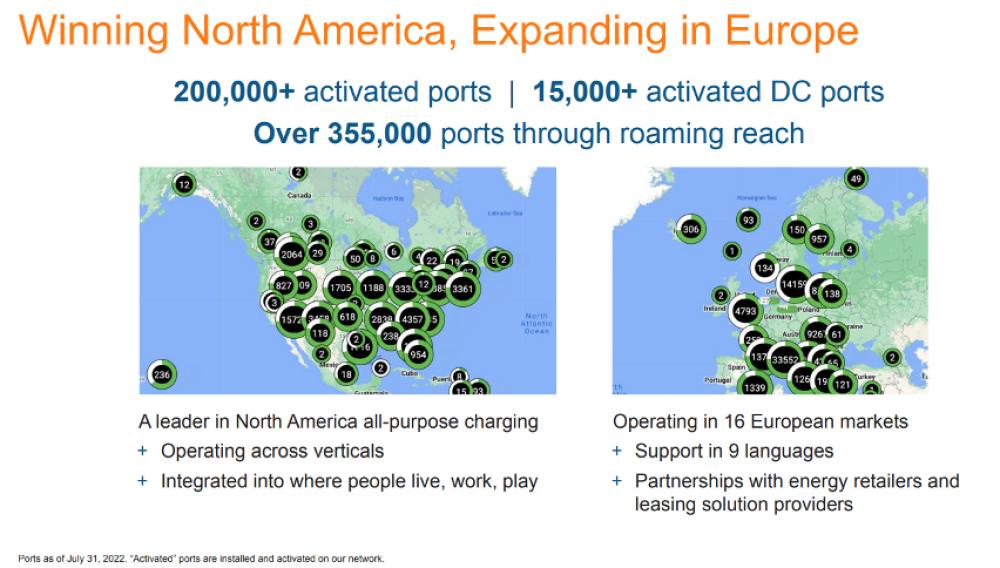

ChargePoint designs, develops, and markets networked electric vehicle charging system infrastructure. These are connected through cloud-based services which enable charging system owners or hosts to manage their networked charging systems and enables consumers to locate, reserve, and transact. It has a presence in North America and Europe and caters to three segments: Commercial, Fleet and Residential. The company has approximately 200,000 ports on its network, including roughly 15,000 DC fast ports. Through its mobile and in-dash apps, ChargePoint enables EV drivers to access over 355,000 additional ports in North America and Europe.

ChargePoint expects revenue to grow in both Networked Charging Systems and Subscriptions segments due to increased demand for EVs and the corresponding charging infrastructure market. It expects research and development expenses to increase on an absolute basis in the near future, as the company continues to invest in R&D activities to achieve its technology and product roadmap. In addition, sales and marketing expenses are likely to grow on an absolute basis for the foreseeable future as it continues to add sales and marketing personnel, expand its sales channels, and expand in Europe.

What differentiates ChargePoint from its peers?

ChargePoint hardly owns the EV charging assets. As a result, the company is largely immune to variations in utilization rates and site selection. Since customers own the charging infrastructure or can partner with a third-party owner-operator, ChargePoint can devote its resources on product development and customer acquisition. According to the company, this operating model enables it to scale network ports more cost effectively than its competitors.

As stated earlier, with an increase in number of EVs on road, EV charging infrastructure will grow irrespective of who ultimately wins the EV race. Moreover, ChargePoint is expected to benefit since it offers networked charging solutions that are capable of charging most types of electric vehicles regardless of their manufacturer. Evidently, this will be beneficial to the growth of the company.

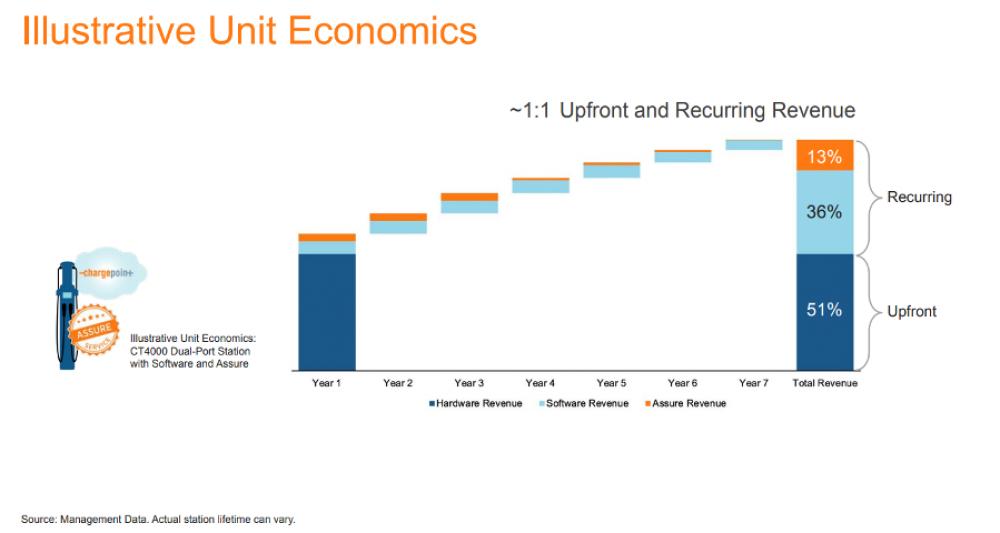

Another crucial factor that separates ChargePoint from its peers is the expected growth in the company’s recurring revenue. ChargePoint believes that the real opportunity doesn’t lie in hardware sales, which generate very little margins. It is the recurring revenue from software and services that will drive the company’s margin growth. ChargePoint explains that, over time, the split between its upfront hardware revenue and recurring software and service revenue from a typical unit is roughly 50-50.

As the chart above illustrates, over roughly seven years, a typical unit sold by ChargePoint earns as much recurring revenue from software and services as it generates upfront from hardware sales in year 1.

Competitors

ChargePoint's primary business model does not involve owning and operating networked charging stations. Thus, the company believes its primary competitors are other OEMs and providers of electric vehicle charging station solutions, such as Blink Charging Co., Wallbox N.V, ABB Ltd., and Tritium DCFC.

According to the company estimates, it has a market dominant share of nearly 70% in publicly available networked Level 2 AC charging in North America. ChargePoint’s growth strategy is to scale networked EV charging by adding new products and by incrementally investing in marketing and sales.

Growth proportional to EV penetration

The next quarter's revenue is expected to be in the range of $125 million to $135 million. For the full year, annual revenue is expected to be $450 million to $500 million. Annual non-GAAP gross margin is predicted to be in the range of 22% to 26%.

In the latest earnings call, CEO Pasquale Romano said “As consumers embrace the transition to EVs at an increasing rate, the future of this business is incredibly strong. Year-on-Year revenue growth of 93% and sequential revenue growth of 33% continue to demonstrate the company’s strength across verticals and geographies”

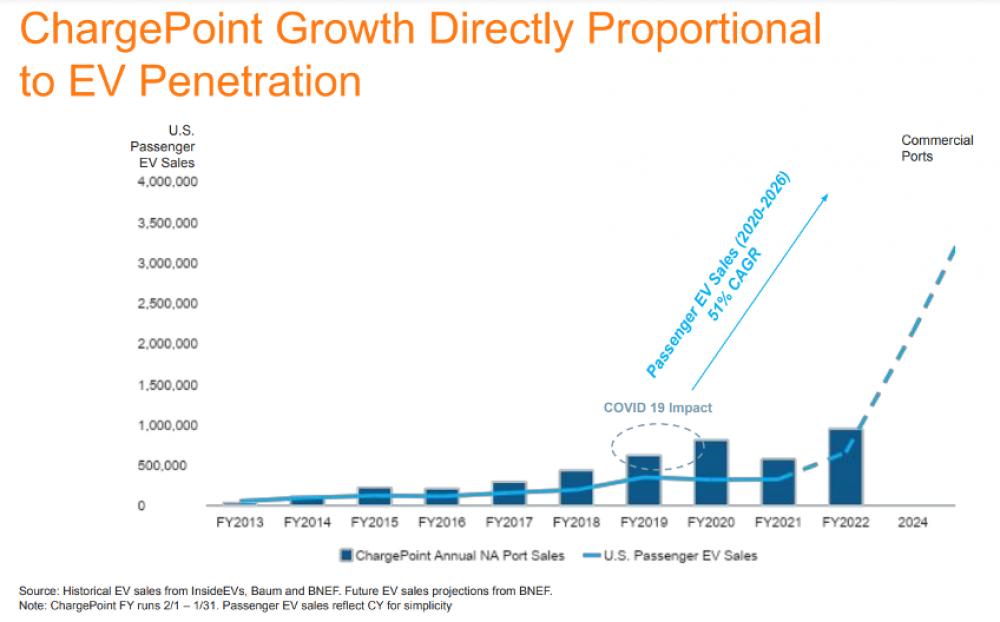

In the long-term, ChargePoint’s growth is expected to be directly proportional to EV penetration.

As the chart above shows, ChargePoint’s annual port sales in North America grew largely in-line with U.S. passenger EV sales in the last decade. The company expects this trend to continue in future. As EV adoption is expected to increase exponentially in the coming years, ChargePoint’s port sales and revenue should grow in tandem. It is expected that ChargePoint will be free cash flow positive by the end of calendar year 2024.

Increased range for EVs driven by improved batteries, faster charging, falling costs, governmental incentives, development of charging infrastructure, and new sleek EV models are some key factors driving the growth in EV adoption. In addition to public charging infrastructure, there is a potential to make home chargers available for use publicly by bringing them on a network. I came across a company named Power Hero which is working to achieve this. Power Hero has developed a no-fuss Cameo adapter that can be attached to any home charger and make it networked. It offers an extremely simple and cost-efficient way to generate a little extra income while helping other EV drivers and contributing to a faster EV growth. As more intelligent P2P networks grow and more businesses and landlords seek to offer solutions, Power Hero technology could provide the backbone to make it all possible.

Impressive revenue growth

For the second quarter of fiscal 2023, ChargePoint’s total revenue stood at $108.2 million as against $56.1 million last year, showing a growth of 93% YoY. Networked charging systems are the major revenue contributor for the company. Networked charging systems revenue more than doubled and stood at $84.1 million in the latest quarter as against $40.8 million last year. Subscriptions revenue grew by 68% year-on-year and stood at $20.2 million in the latest quarter, as against $12 million last year.

The total cost of revenue increased at a faster pace than revenue. Due to this, the company saw a decrease in gross profit margins, even though gross profit numbers increased. There was also an increase in other operating expenses for the company. Research and development, which contributes the bulk of operating costs, increased by 28% whereas sales and marketing expenses increased by 55%.

Why loss-making EV infrastructure companies are still a good investment

Although EV charging companies are experiencing operating losses in the current situation, they still could be potential profit machines with the widespread adoption of EV transportation. That’s why these EV charging stocks are potential multi-baggers. Companies like Power Hero can be instrumental in making this possible.

Overall, player with an early-mover advantage like ChargePoint can retain the significant market share that it enjoys today in the EV charging space. Early investors will benefit eventually as the EV ecosystem grows.

More to Read:

Previous Posts: